Spend any time around a coin shop or precious metals dealer, and you’re bound to hear references to “silver stackers.” They may get mentioned in both positive and negative contexts, along with oblique statements about their characteristics. A silver stacker is a person who prioritizes the acquisition of silver bullion as a primary focus of…

Owning gold or silver is great. Either precious metal offers a tangible store of value. In many cases, having one of these metals in your portfolio is a great way to guard against oscillations in the economy. However, owning gold or silver also puts a particular onus on you. Namely, you have to be able…

When I first started my financial journey as a young man, I quickly realized how complex and diverse the financial markets are. After spending many years investing and managing real estate, obtaining government licenses in investments such as stocks, bonds, and commodities, and working for a major US forex (money) dealer learning the ropes in…

The first question about the precious metals markets always comes up: How do I get started? The second question is what strategies should one use when building up their portfolio of precious metals? And those are very good questions! So, let’s discuss the basics of the gold and silver buying process. The “Spot” Price The…

With inflation continuing to rise dramatically in the US, you may find yourself searching for alternate stores of wealth to the weakening dollar. In that search, you may encounter mentions of sovereign bullion, but not any descriptions of what it is, why you should use it, and where to find it. We’re here to help….

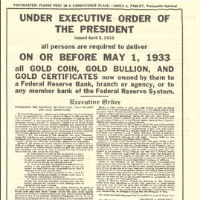

A large portion of gold bullion buyers have either heard of or know about President Franklin D. Roosevelt’s 1933 Executive Order 6102 when the US government outlawed large private gold bullion ownership. Many silver bullion buyers are yet unaware of the President Roosevelt administration’s Executive Order 6814 which occurred over one year later. Shortly after…

An industry wide gold and silver bullion shortage occurred during the 2008 Financial Crisis. It began in early September 2008 and lasted all the way into the spring of 2009. During this time the world’s largest Government Mints and Private Mints could not supply enough bullion coins and bars to meet global demand. In North…

Let us begin by defining what we mean by either a gold bullion shortage or a shortage of silver bullion supplies. Bullion Shortage – (n) when the physical bullion market’s available bullion supply for sale and immediate delivery is unable to sufficiently meet the investing public’s demand. Today the majority of the wealth within the…

When did silver coins stop and disappear from circulation? In this article we will review both the issuance and disappearance of circulating silver coins throughout North America specifically the United States, Canada, and Mexico. Old US Silver Coins For decades following President Roosevelt’s 1934 Silver Nationalization, the United States forced a government mandated silver price…

If you want to sell some gold or silver, you can do so either online or in-person. There are tradeoffs for both methods. Online dealers are plentiful and offer the convenience of a transaction without the safety issues that you have to endure to sell your metals in person. However, online dealers understand that those…

Now that you are well educated on the precious metal market, and have an understanding of the advantages of buying precious metals online, we are going to fully explain our order process here at JM Bullion. The article below will guide you through the entire process – starting with your first visit to our website,…

By reaching this point in our investing guide, you have received a well-rounded precious metals education, and may be thinking about making your first investment. If so, you may still be a bit confused as to what precious metal products are best for your personal investment goals and financial situation. Below we have listed our…

The question about how much gold and silver should be part of a portfolio has dogged investors for more than a century. After all, there are no greater stores of actual value than precious metals like gold and silver. However, the true answer to the question is as personal as they come. Every investor has…

When investing in gold and silver for the first time, it is very easy for customers to become overwhelmed by the many options offered to them. Whether faced with the decision of which products to order or how much to pay, the choices can seem endless. Fortunately, customers can rest assured knowing that there is…

Today, buying gold and silver is easier than ever since there are so many options available. However, this abundance of purchase options will often raise the question of what is the best way to buy precious metals. Our answer is that the “best” way will depend on the individual preferences and needs of the customer….

At JM Bullion, we are dedicated to helping our customers get the most out of their investment purchases, which is why we offer the option of purchasing gold and silver in bulk quantities at discounted prices. Buying gold and silver in large quantities offers multiple benefits. From an investment standpoint, purchasing in bulk allows you…

Years ago, collectors and investors were required to visit local coin shops to purchase gold or silver. Fortunately, customers now have the benefit of shopping online for all their precious metal needs. From larger product selection to lower prices, there are many benefits to purchasing gold and silver from an online dealer. While we may…

Despite the convenience of online dealers, many customers prefer to shop at local coin shops for their precious metal needs. There can be a number of reasons why people choose to purchase their gold and silver locally. For some, making their purchase in person adds an extra level of security. For others, it saves them…

Since its establishment in 2008, the online payment system known as Bitcoin has enabled millions of customers to make and receive payments without the involvement of any banks or credit/debit card companies. The popularity of this payment method stems not only from the convenience of its transaction process, but also from the currency it uses,…

For many customers, eCheck provides a secure and efficient means of paying for their precious metals purchases. As with regular checks, eCheck enables customers to transfer funds directly from their bank account to their online dealer. However, unlike their paper counterpart, eChecks spare customers the trouble of mailing a check through an instant online transaction. Still, despite the…

Paper checks offer customers with an easy and secure form of payment for their gold and silver purchases. Orders made with paper checks are immediately entered into the shipping queue after a 3-5 day mandatory clearance period. Unfortunately, we MUST wait these 3-5 days before releasing an order into the shipping queue without exception to…

Bank wires provide customers with a simple, fast, and secure payment method for their gold and silver purchases. Bank wire payments clear the moment we receive them, and are typically faster than other payment methods, such as sending a check in the mail. Bank wires are ideal for customers that are making larger investments in…

One of the quickest and most convenient ways to buy gold and silver online is using a credit or debit card. Credit and debit cards offer swift clearance, extra security and enter our shipping queue as soon as the payment is processed. Purchases eligible for payment via credit/debit card have a maximum of $5,000. JM…

PayPal provides customers with a fast and convenient payment method for buying gold and silver online. Because PayPal orders clear instantly, they are immediately entered into our shipping queue. Orders paid through PayPal are eligible for extra coverage through the company’s Buyer Protection policies. They are also eligible for flexible payment options through its BillMeLater…