How Has My Investment Performed?

JM Bullion ROI Calculator

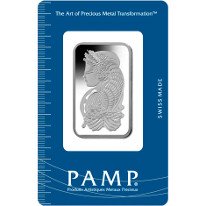

Find out how much your is worth in a few easy steps

Free Platinum Price Widget For Your Website

Share live platinum prices with your website followers or on your blog, using our free platinum price widget. To get started, please select one of the size dimensions from the drop-down menu below, and copy the code from the Widget Code text box and paste it into the desired position in your page. If you have any trouble, please contact us at support@jmbullion.com.